Contents:

An asset’s salvage value must be subtracted from its cost to determine the amount in which it can be depreciated. Calculating and maintaining supporting amortization schedules for both book and tax purposes can be complicated. Using accounting software to manage intangible asset inventory and perform these calculations will make the process simpler for your finance team and limit the potential for error. Amortization in accounting is the process of expending an asset’s value over the period of its useful life in your balance sheet. So, the cost required to procure or manage the asset is recorded in the expense sheet rather than the income statement. By decreasing the assets’ value, you thereby reduce the taxable income.

Amortization helps businesses and investors understand and forecast their costs over time. In the context of loan repayment, amortization schedules provide clarity into what portion of a loan payment consists of interest versus principal. This can be useful for purposes such as deducting interest payments for tax purposes. A company’s intangible assets are disclosed in the long-term asset section of its balance sheet, while amortization expenses are listed on the income statement, or P&L. Amortization is a technique of gradually reducing an account balance over time.

Either way, their value holds a financial significance and must not be ignored. During any accounting exercise, you must evaluate the values of these assets — every year. It can be your brand value, R&D inventions, business secrets, or intellectual properties you own. Subtract the residual value of the asset from its original value.

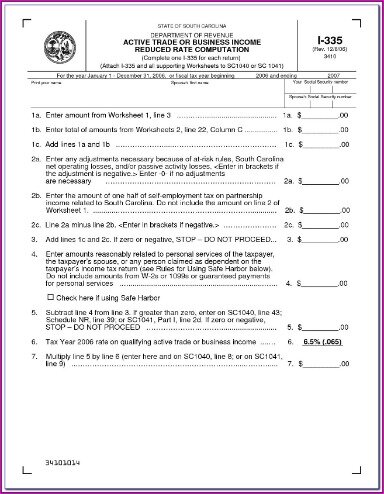

Amortization for Tax Purposes

Another difference is the accounting treatment in which different assets are reduced on the balance sheet. Amortizing an intangible asset is performed by directly crediting that specific asset account. Alternatively, depreciation is recorded by crediting an account called accumulated depreciation, a contra asset account. The historical cost fixed assets remains on a company’s books; however, the company also reports this contra asset amount to report a net reduced book value amount. In contrast, intangible assets that have indefinite useful lives, such as goodwill, are generally not amortized for book purposes, according to GAAP. Amortization is important because it helps businesses and investors understand and forecast their costs over time.

Brandywine Realty Trust Announces First Quarter Results – GlobeNewswire

Brandywine Realty Trust Announces First Quarter Results.

Posted: Wed, 19 Apr 2023 20:30:00 GMT [source]

It can also mean the deduction of capital expenses over the assets useful life where it measures the consumption of intangible asset’s value. Examples of the kind of assets that impact this kind of amortization are goodwill, a patent or copyright. You can also use amortization to help reduce the book value of some of your intangible assets. Amortization is an accounting technique used to spread payments over a set period of time.

Not all loans are designed in the same way, and much depends on who is receiving the loan, who is extending the loan, and what the loan is for. However, amortized loans are popular with both lenders and recipients because they are designed to be paid off entirely within a certain amount of time. It ensures that the recipient does not become weighed down with debt and the lender is paid back in a timely way. As shown, the total payment for each period remains consistent at $1,113.27 while the interest payment decreases and the principal payment increases. Negative amortization is when the size of a debt increases with each payment, even if you pay on time. This happens because the interest on the loan is greater than the amount of each payment.

Calculating the amortization of a loan

As a result of the impairment, the amortization expense on the patent should be adjusted to reflect the new value. To find the amortized acquisition cost the securities are amortized like a mortgage or a bond. This is the process of scheduling intervals of payment over time to pay back an existing debt, taking into account the time value of money. Amortization and depreciation are similar in that they both support the GAAP matching principle of recognizing expenses in the same period as the revenue they help generate.

On the other hand, due to the yearly amortization of assets, the balance sheet is affected as it reduces the asset side of the statement. Non-cash ChargesNon-cash expenses are those expenses recorded in the firm’s income statement for the period under consideration; such costs are not paid or dealt with in cash by the firm. DepreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset’s worth has been utilized. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. Only recognized intangible assets with finite useful lives are amortized.

Interested in automating the way you get paid? GoCardless can help

A broader amortization definition includes the process of gradually paying off a debt over a set amount of time and in fixed increments, commonly seen in home mortgages and auto loans. With home and auto loan repayments, most of the monthly payment goes towards interest early in the loan. Each subsequent payment is a greater percentage of the payment goes towards the loan’s principal.

SL Green Realty Corp. Reports First Quarter 2023 EPS of ($0.63 … – GlobeNewswire

SL Green Realty Corp. Reports First Quarter 2023 EPS of ($0.63 ….

Posted: Wed, 19 Apr 2023 20:05:00 GMT [source]

Negative amortization is particularly dangerous with credit cards, whose interest rates can be as high as 20% or even 30%. In order to avoid owing more money later, it is important to avoid over-borrowing and to pay your debts as quickly as possible. The beginning loan balance is amount of debt owed at the beginning of the period. This amount is either the original amount of the loan or the amount carried over from the prior month (last month’s ending loan balance equals this month’s beginning loan balance). Amortization typically refers to the process of writing down the value of either a loan or an intangible asset. Explain when to record depreciation expenses when a new asset is purchased.

Amortization does not relate to some intangible assets, such as goodwill. Accumulated amortization is the cumulative amount of overall expenses written off against any intangible asset. In balance sheet terms, this is the sum of everything recorded on the debit side related to the intangible asset. In other words, it means spreading out the value of an intangible asset over its lifetime. This is also applicable to loans whose book value reduces over the years through fixed and varied interest rates. Two scenarios are described by the term “amortization.” First, amortization is used in repaying debt over time with consistent principal and interest payments.

Therefore, it must be depreciated or amortized in the books of accounts to recognize its true value. Companies use methods like depreciation or amortization to depreciate the asset over its useful life. Download our free work sheet to apply amortization to intangible assets like patents and copyrights. Amortization impacts a company’s income statement and balance sheet.

Why Is Amortization Important to Know and Understand?

Amortization enables organizations to either pay off debt in equal installments over time or to allocate the cost of an intangible asset over a period of time for accounting and tax purposes . For tax purposes, there are even more specific rules governing the types of expenses that companies can capitalize and amortize as intangible assets, as we’ll discuss. Amortization also refers to a business spreading out capital expenses for intangible assets over a certain period.

This can be to any number of things, such as overall use, wear and tear, or if it has become obsolete. There are various methods used by the business to calculate depreciation. However, there is only one method of amortization that companies generally use. Every year the business records a decrease in the patent’s value, it must also record a corresponding amortization expense equal to the decrease.

The amount to be amortized is its recorded cost, less any residual value. However, since intangible assets are usually do not have any residual value, the full amount of the asset is typically amortized. If you pay $1,000 of the principal every year, $1,000 of the loan has amortized each year. You should record $1,000 each year in your books as an amortization expense. And amortization of loans can come in especially handy for any repayments. It’s a technique used to help reduce the book value of any loans you have.

Under GAAP, for book purposes, any startup costs are expensed as part of the P&L; they are not capitalized into an intangible asset. Entrepreneurs often incur startup costs to organize a business before it begins operating. In the example above, the loan is paid on a monthly basis over ten years. Negative amortization can occur if the payments fail to match the interest. In this case, the lender then adds outstanding interest to the total loan balance.

Resources for Your Growing Business

It means any asset that can be touched and felt could be labeled a tangible one with a long-term valuation. The process of amortization requires decreasing the value of the asset annually by an amount equal to the value of the asset divided by the number of years of the patent’s useful life. This means that the book value of the copyright is divided by the useful life of the copyright to determine the amortization amount. Held to maturity securities are reported at amortized cost less impairment.

It also has a unique set of rules for tax purposes and can significantly impact a company’s tax liability. Amortization is the accounting process used to spread the cost of intangible assets over the periods expected to benefit from their use. Amortization also refers to the acquisition cost of intangible assets minus their residual value. In this sense, the term reflects the asset’s consumption and subsequent decline in value over time. Depreciation and amortization both mean the same in accounting terms. But depreciation is used to measure the value of tangible assets.

When applied to an asset, amortization is similar to depreciation. The advantage of accelerated amortization for tax purposes lies in the deferment of taxes rather than in their reduction. A financial problem may result later from the absence of any deduction in the normal income taxes for depreciation. Income-tax expenses can be equalized, however, by treating taxes not paid in the early years as a deferred tax liability. Intangible assets do not have physical properties but do have value. Like amortization, depreciation is a method of spreading the cost of an asset over a specified period of time, typically the asset’s useful life.

Accelerated amortization was permitted in the United States during World War II and extended after the war to encourage business to expand productive facilities that would serve the national defense. In the 1950s, accelerated amortization encouraged the expansion of export and new product industries and stimulated modernization in Canada, western European nations, and Japan. Other countries have also shown interest in it as a means of encouraging industrial development, but the current revenue lost by the government is a more serious consideration for them. In the amortization journal entry, the discount account will be ______ .

- When in doubt, please consult your lawyer tax, or compliance professional for counsel.

- Under International Financial Reporting Standards, guidance on accounting for the amortization of intangible assets is contained in IAS 38.

- Thus, it writes off the expense incrementally over the useful life of that asset.

Many average collection period formula of amortization in business relate to intellectual property, such as patents and copyrights. You can use the amortization schedule formula to calculate the payment for each period. Over time, after the series of payments, the borrower gradually reduces the outstanding principal. The process of value reduction for a debt or an intangible asset is known as amortization. When an asset brings in money for more than one year, you want to write off the cost over a longer time period.

The term “amortization” is used to describe two key business processes – the amortization of assets and the amortization of loans. We’ll explore the implications of both types of amortization and explain how to calculate amortization, quickly and easily. First off, check out our definition of amortization in accounting. This is especially true when comparing depreciation to the amortization of a loan. AmortizationAmortization of Intangible Assets refers to the method by which the cost of the company’s various intangible assets is expensed over a specific time period. One notable difference between book and amortization is the treatment of goodwill that’s obtained as part of an asset acquisition.

Truist reports first quarter 2023 results – ShareCast

Truist reports first quarter 2023 results.

Posted: Thu, 20 Apr 2023 10:55:00 GMT [source]

He is the sole author of all the materials on AccountingCoach.com. Get up and running with free payroll setup, and enjoy free expert support. You should now have the periodical amount that you can amortize. Next, divide this figure by the number of months remaining in its useful life. Amortization is a fundamental concept of accounting; learn more with our Free Accounting Fundamentals Course.

As time progresses, more of each payment made goes toward the principal balance of the loan, meaning less and less goes toward interest. The ending loan balance is the difference between the beginning loan balance and the principal portion. This represents the new debt balance owed based on the payment made for the new period.